A Biased View of Small Business Accountant Vancouver

Wiki Article

Rumored Buzz on Tax Consultant Vancouver

Table of ContentsHow Small Business Accounting Service In Vancouver can Save You Time, Stress, and Money.Tax Consultant Vancouver Can Be Fun For Anyone8 Easy Facts About Small Business Accountant Vancouver ShownSmall Business Accounting Service In Vancouver - QuestionsSome Known Details About Tax Accountant In Vancouver, Bc Getting The Small Business Accounting Service In Vancouver To Work

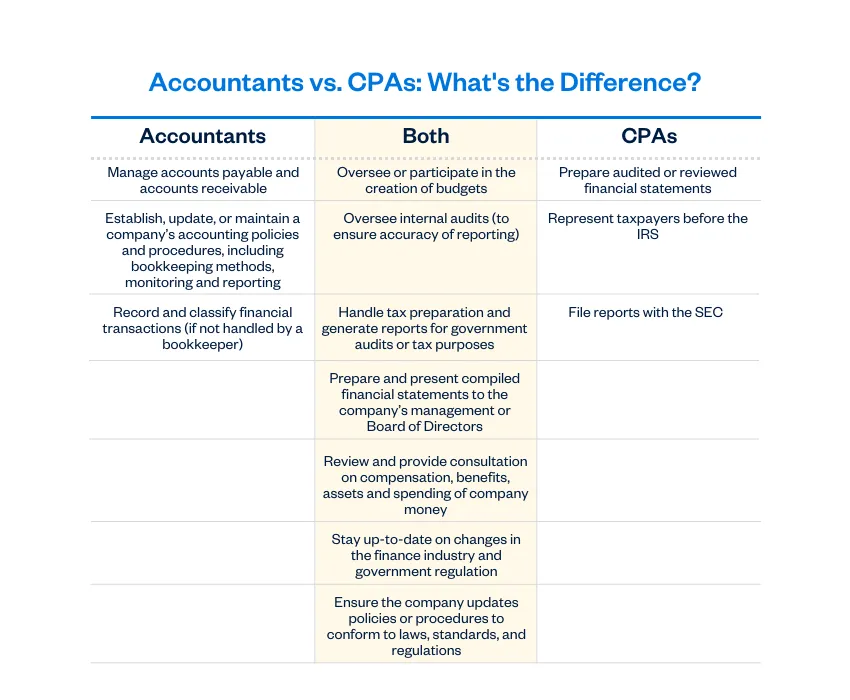

Right here are some benefits to employing an accountant over an accountant: An accounting professional can offer you an extensive sight of your company's monetary state, in addition to techniques as well as recommendations for making monetary decisions. On the other hand, accountants are only responsible for tape-recording financial transactions. Accounting professionals are needed to finish more schooling, qualifications and also job experience than accountants.

It can be tough to gauge the proper time to work with a bookkeeping professional or bookkeeper or to figure out if you require one in any way. While lots of tiny organizations work with an accounting professional as a professional, you have numerous options for taking care of economic tasks. For instance, some local business owners do their very own bookkeeping on software their accounting professional suggests or utilizes, providing it to the accountant on a weekly, month-to-month or quarterly basis for activity.

It might take some background research to find an ideal bookkeeper due to the fact that, unlike accounting professionals, they are not required to hold a specialist accreditation. A strong recommendation from a relied on coworker or years of experience are vital elements when employing a bookkeeper.

6 Easy Facts About Cfo Company Vancouver Shown

For tiny businesses, skilled money management is an important aspect of survival and growth, so it's smart to function with a financial specialist from the begin. If you favor to go it alone, take into consideration starting with accountancy software program and also keeping your books carefully as much as day. This way, should you need to work with a professional down the line, they will have visibility right into the total financial background of your service.

Some resource interviews were performed for a previous variation of this post.

Not known Factual Statements About Virtual Cfo In Vancouver

When it pertains to the ins as well as outs of taxes, bookkeeping and also financing, nevertheless, it never harms to have an experienced expert to resort to for advice. A growing variety of accountants are also caring for things such as cash circulation estimates, invoicing as well as human resources. Eventually, a number of them are handling CFO-like duties.Tiny organization proprietors can expect their accounting professionals to help with: Selecting business framework that's right for you is essential. It influences how much you pay in taxes, the paperwork you need to submit and also your individual liability. If you're looking to transform to a various service framework, it can cause tax obligation repercussions and also various other problems.

Also companies that are the exact same size as well as industry pay really various amounts for accountancy. These expenses do not transform into cash money, they are necessary for running your company.

Not known Details About Small Business Accountant Vancouver

The average price of audit solutions for little company differs for each unique scenario. The average monthly audit fees for a small business will increase as you include a lot more solutions as well as the jobs obtain harder.You can tape purchases as well as process payroll making use of on-line software program. You enter amounts right into the software program, as well as the program computes overalls for you. Sometimes, pay-roll software for accountants permits your accountant to offer payroll processing for you at very little extra expense. Software application remedies are available in all forms as well as sizes.

The Greatest Guide To Tax Consultant Vancouver

If you're a brand-new service proprietor, do not neglect to variable accountancy costs right into your budget. Management costs and also accounting professional costs aren't the only accounting expenditures.Your time is also valuable as well as need to be taken into consideration when looking at accounting costs. The time invested on accountancy jobs does not generate earnings.

This is not planned as legal suggestions; for additional information, please go here..

Get This Report about Vancouver Accounting Firm

Report this wiki page